Beyond Data.

Intelligence.

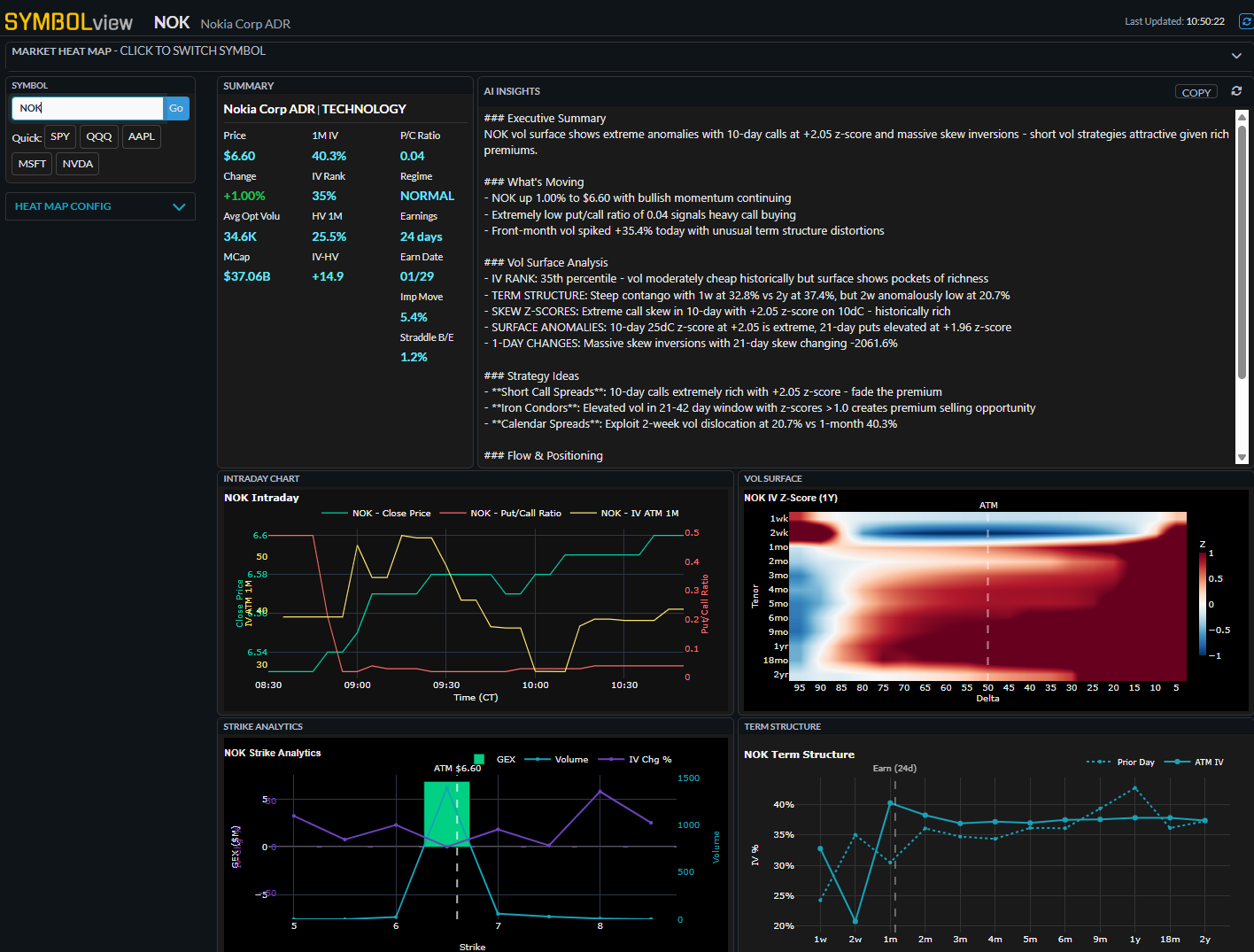

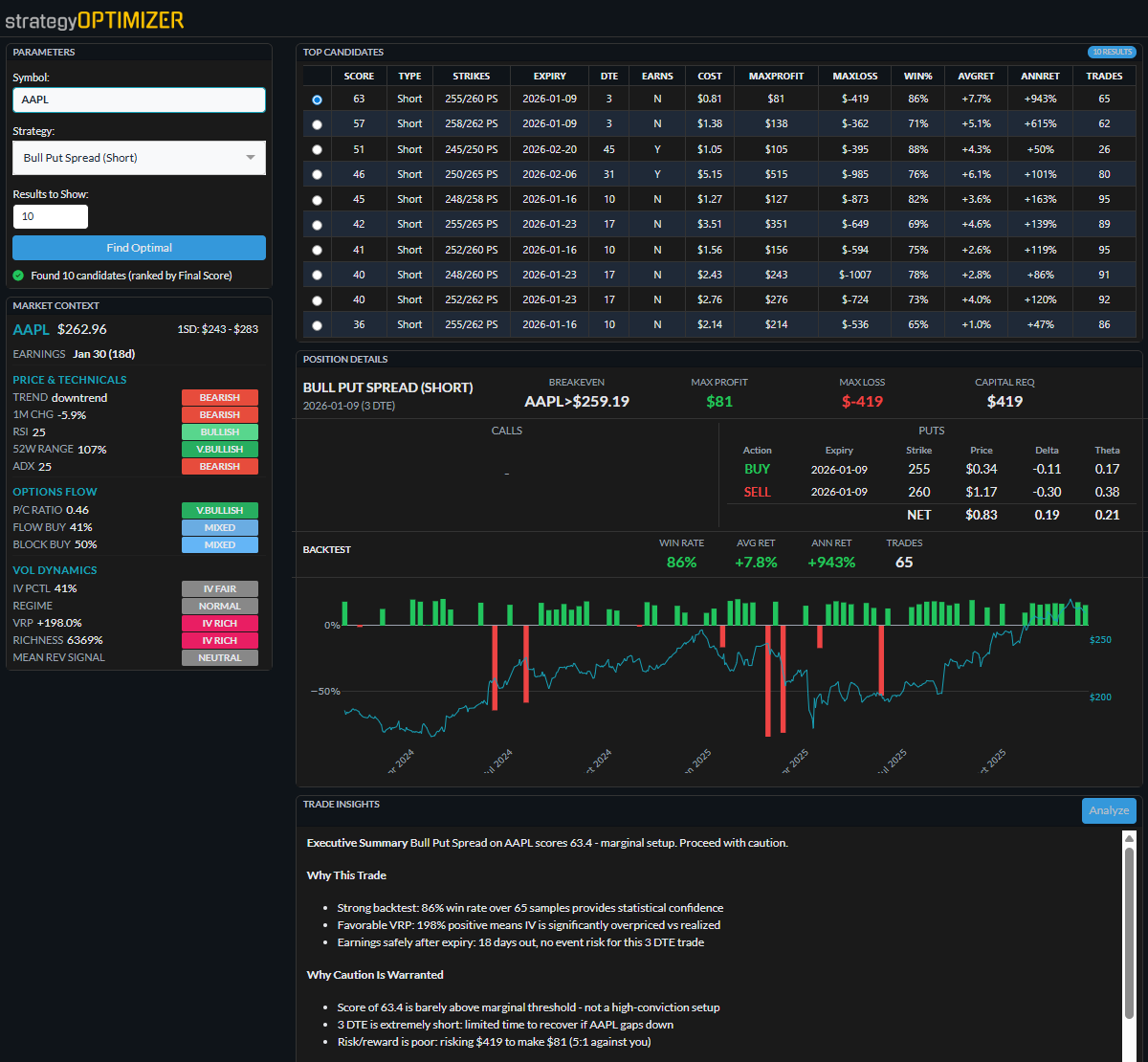

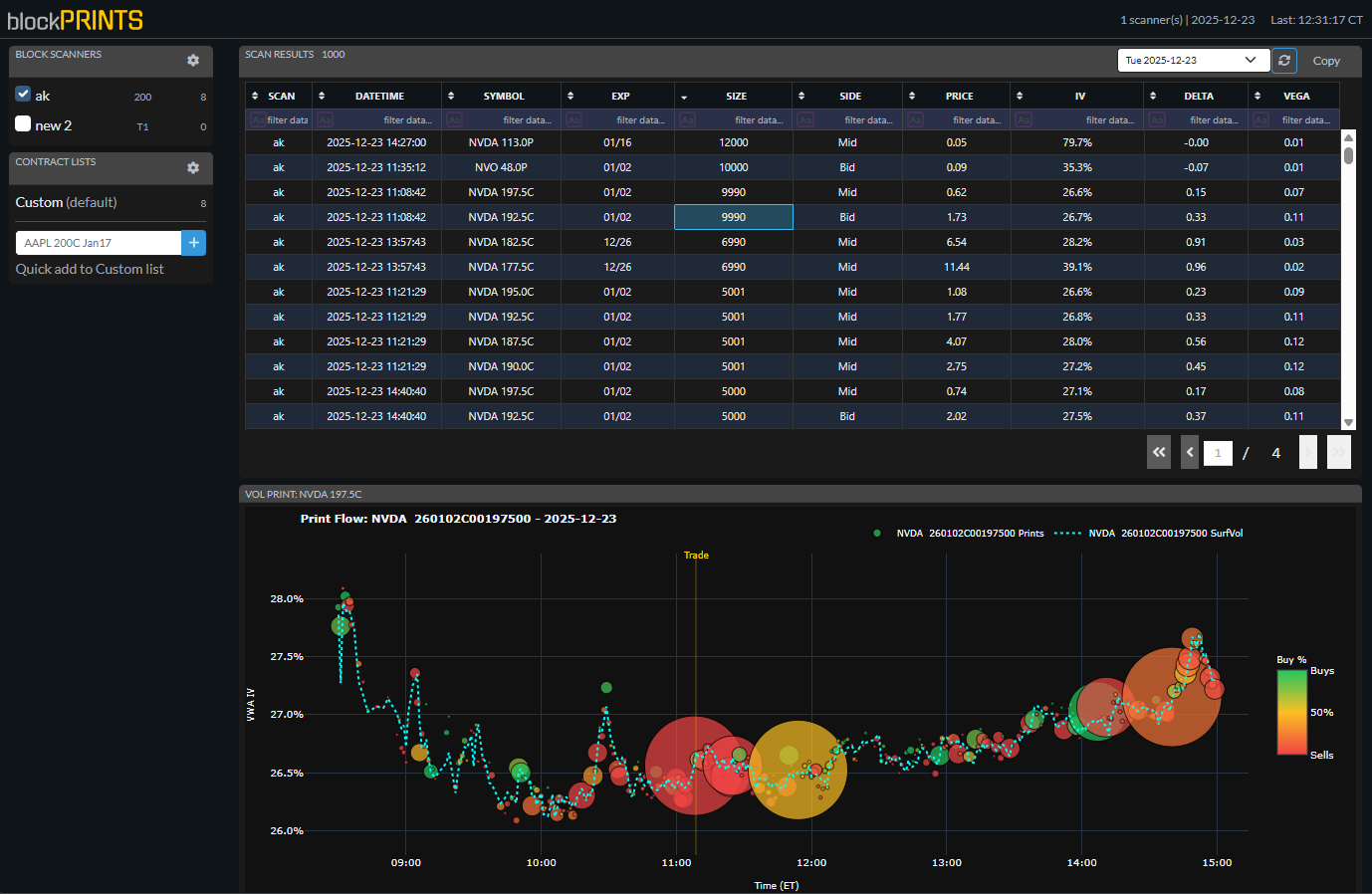

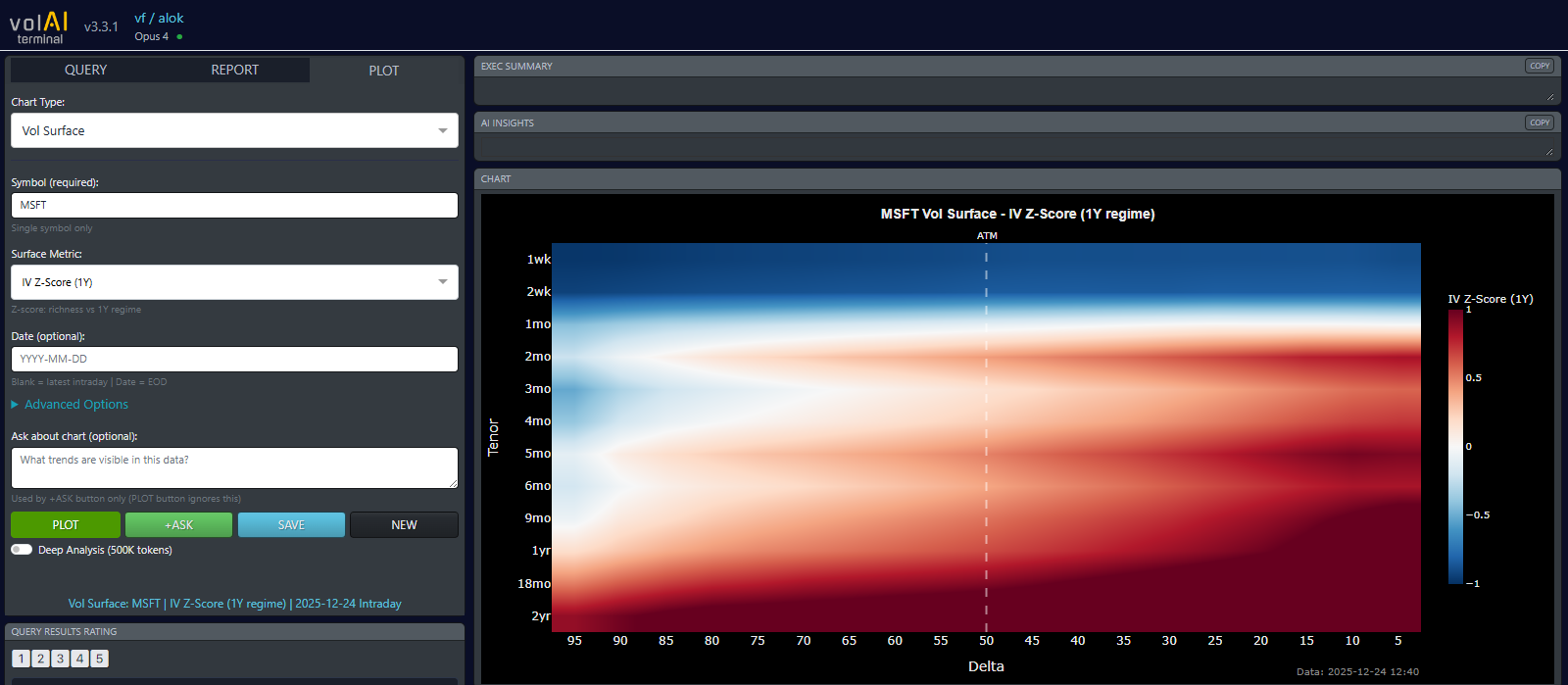

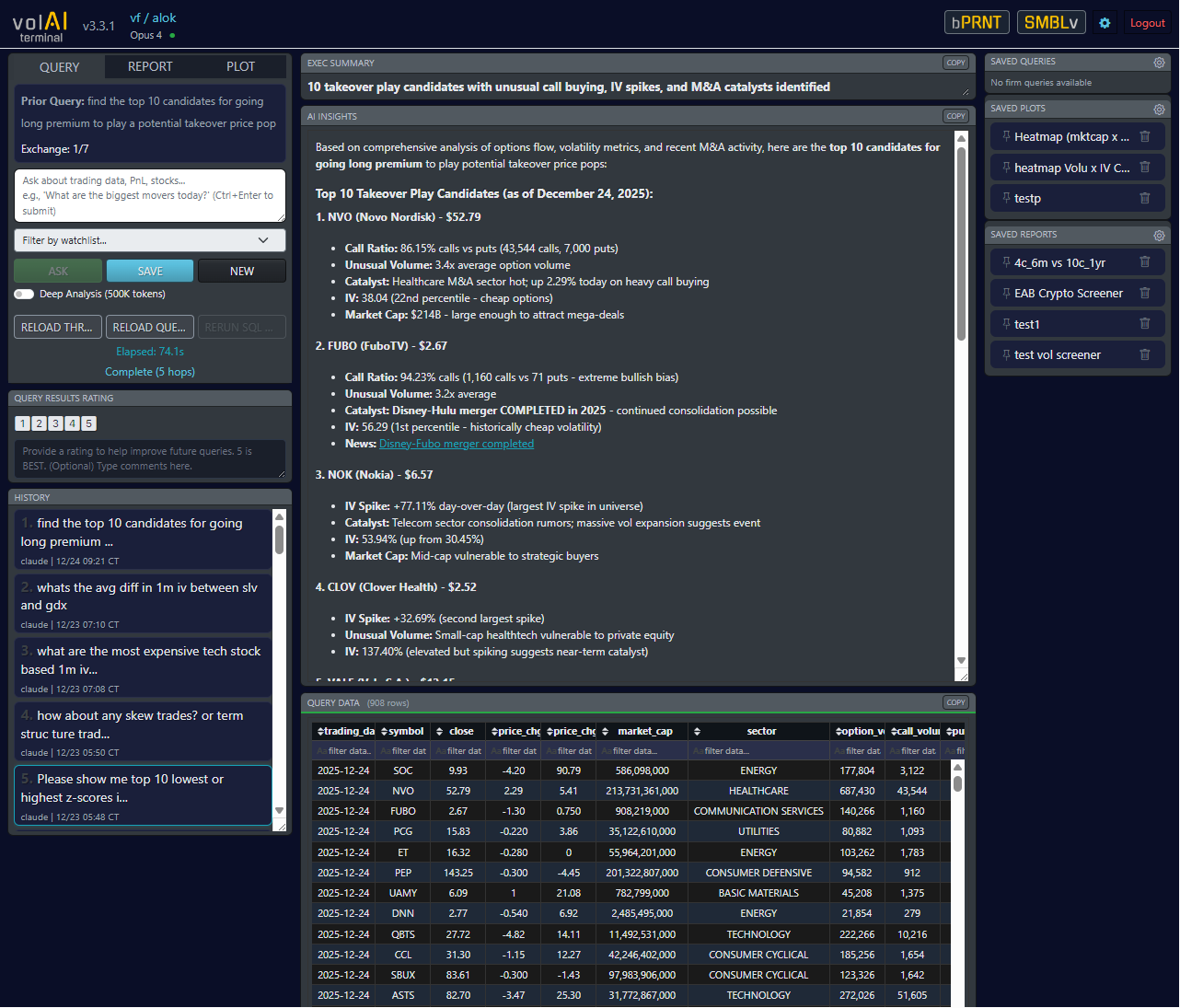

AI volatility intelligence for institutional options desks. Used by vol traders, PMs, and sell-side teams to surface edge faster.

Data Overload

Millions of strikes, thousands of names - signal drowns in noise

Screen Fatigue

Filters need constant tuning - good setups slip through

Exploration Friction

Deep dives take too long - ideas die before execution

Expertise Gap

Junior staff can't reason like senior vol traders

Hours of expert-level analysis, delivered in seconds.